Welcome to our blog on brokers! Brokers are like middlemen and they play an important role. In this blog we provide you with the information you need to know all about brokers in detail. Whether you are a beginner or an experienced investor, we are here to simplify the world of brokers for you.

What is a Broker?/Meaning of Brokers

Brokers refer to those individuals or entities that help people to buy, sell or trade. They play a pivot role as the securities exchanges only accept the orders of the individuals and firms who are a member of their exchange. Hence we need their services. They act as an intermediary and arrange transactions between the buyer and the seller. They charge a fee or commission for executing buy and sell orders of the invertors.

What are the types of Brokers?

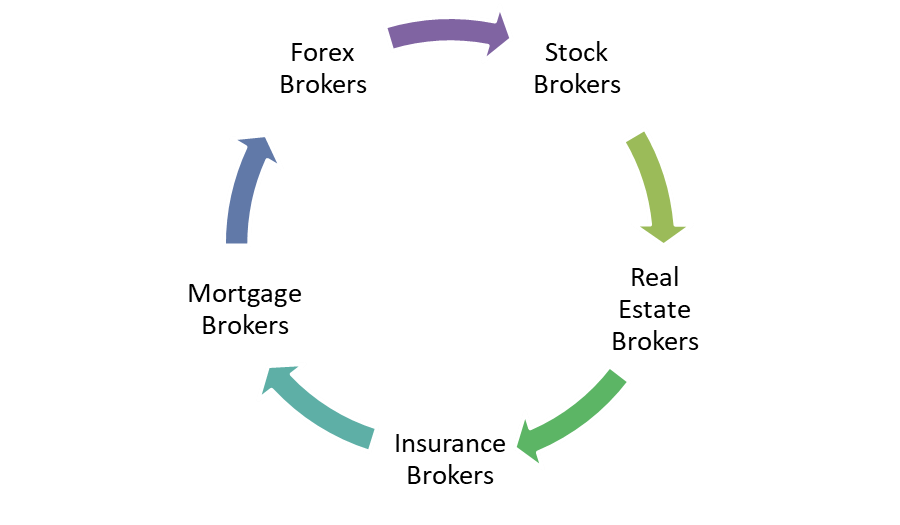

Brokers play a crucial role in various industries, including finance, real estate, insurance and commodities trading. They come in various types depending upon the area specialized and services provided to their clients. Given below are some of the different types of brokers.

1. Stock Brokers: They are also known as securities brokers. They are licensed intermediaries who provide trading services to clients. They assist clients in buying and selling stocks and other securities on stock exchanges. They provide investment advice, execute trades and manages clients’ investment portfolio.

2. Real Estate Brokers: They are people who have earned a professional license to serve as a middleman in selling, purchasing and renting of real estate. They represent sellers or buyers of real estate or real property. They oversee real estate transactions, negotiate deals and ensure legal compliance.

3. Insurance Brokers: They help clients find and purchase insurance policies that suit their needs. They provide expert advice on various types of insurance, including life, health, property and auto insurance.

4. Mortgage Brokers: They help individuals and businesses secure loans for purchasing real estate properties. Mortgage brokers play a crucial role in purchasing a house since they are a bridge between loan applicants and financial institutions.

5. Forex Brokers: They facilitate currency trading for individuals and business concerns in the global forex market. They provide a platform to buy and sell foreign currency in the capital markets.

Brokerage Fees and Commission to Brokers

Brokers charge a fee or commission for the services they provide to individuals and business concerns. Brokerage fees are small commissions a broker charges to their clients for the management and execution of financial transactions and other services provided to the clients. These fees can vary depending upon the type of broker and the services provided. . These fees can include commission fees for buying and selling securities, management fees for investment advisory services, etc. For example, stock brokers charge commission for executing stock trades, while forex brokers may charge commission fees based on trade volume. Other fees charged by the all brokers in common include account maintenance fees, inactivity fees and transaction fees. It is crucial for investors to understand these fees and factor them into their investment decisions when selecting a broker.

Regulation

Regulation in the brokerage industry serves as a cornerstone for maintaining transparency, integrity and investor protection within financial markets. Brokers register with the Financial Industry Regulatory Authority (FINRA), the broker-dealers’ self-regulatory body. In serving to their clients, brokers are held to a standard of conduct based on the suitability rule, which requires there be reasonable grounds for recommending a specific product or investment. Securities Exchange Board of India (SEBI) rules apply to stock brokers. Whether they are real estate brokers, insurance brokers or stock brokers they are subject to strict regulation by the authorized body that governs the area they specialize in.

Conclusion

In conclusion, brokers serve as an essential intermediary in the working of many industries including finance, insurance, real estate and commodities trading. Whether it is to buy or sell a real estate property or to trade in stock exchange or to purchase an insurance policy, brokers play a crucial role in it. Throughout this blog we have explored the meaning of brokers, the types of brokers, commission or brokerage fees charged by the brokers and the regulatory framework that governs the brokers. Whether you are a beginner or an experienced trader, brokers offer valuable expertise and support to help you achieve your financial goals with confidence.