A home is not just a place to stay. It is a place where one make memories, go through various experiences, circumstances, emotions and a lot more. Home loans offer individuals and families the necessary finance to achieve the dream of owning a home. It is a type of loan specifically designed for purchasing or refinancing a home. It is a long term loan with a repayment period ranging from 20-30 years.

Features of a Home Loan

Depending on the lender and the specific type of loan, its features can vary. Given below are some of the common features of a home loan:

1. Loan Amount- The maximum amount of money that a lender is willing to lend you to purchase a home is based on certain factors. It is often based on the factors such as your income, credit score and the value of the property.

2. Interest Rate- Home loans typically offer lower interest rates compared to other types of loans, like personal loans and credit loans. The rate at which interest is charged on the loan amount can be fixed or variable depending on the market conditions.

3. Flexible Repayment Periods- Home loans offer flexibility in the repayment of the loan taken. The repayment period can range from 20 to 30 years.

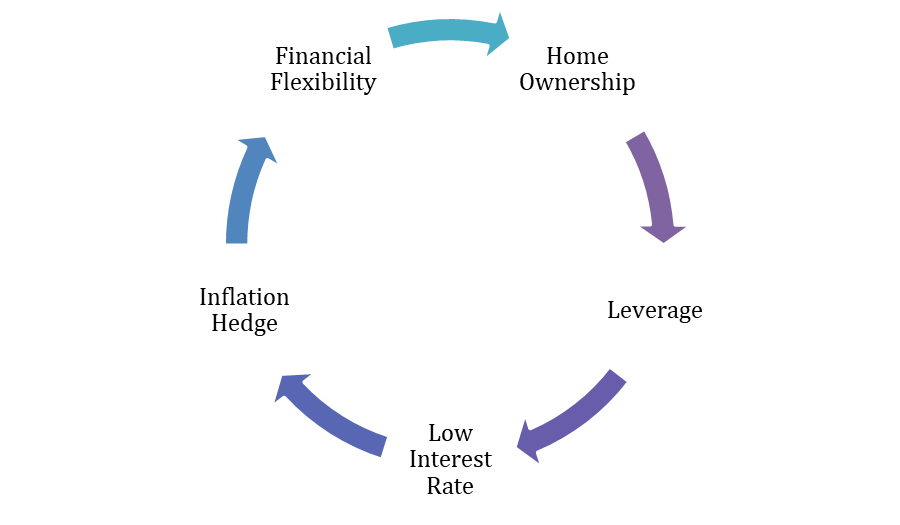

Benefits of Home Loan

Types of Home Loans

There are a variety of loans that are offered by banks in the market depending on the purpose and preferences of the borrower. The following are some of the different types of loans offered by lenders:

- Home Loan- This is the most common type of home loan availed to purchase a house. There are a lot of public and private banks and other housing finance corporations that offer these loans.

- Home Improvement Loan- This type of loan provides for the necessary finance required for renovating and repairing the house if there are any issues in the existing building.

- Home Extension Loan- This loan provides the finance if you want to extent your present home, say, extend or build another room or a floor.

- Composite Home Loan- This loan provides the financing for purchasing the plot of loan where you wish to construct a house or for the construction of a house or for both.

Conclusion

In conclusion, a home loan plays a very important role in facilitating home ownership for individuals and families. They help borrowers to achieve their home ownership goals while building equity and stability for future. They not only just provide financial investment but also offer a wide range of benefits. They empowers individuals and also create a sense of security and belonging that enriches lives and strengthens communities.