In this blog, we will help you understand what investment banking is, its role in the present financial system, its importance, what investment bankers do and other topics related to it.

What Is Investment Banking ?

Investment banking is a sector of the financial industry. It is a type of banking that provides a range of activities to corporation, governments, institutions, etc. in organizing large and complex financial transactions such as mergers or initial public offering (IPO), underwriting. They act as intermediaries, helping new firms to go public. These banks may raise money for companies in many ways, including underwriting the issue of various securities. Their services primarily revolve around facilitating various financial transactions and advisory services.

Who Are Investment Bankers ?

Investment bankers are professionals who work in the investment banking industry and specialize in providing financial advisory services and facilitating various financial transactions for corporations, governments and high net worth individuals.

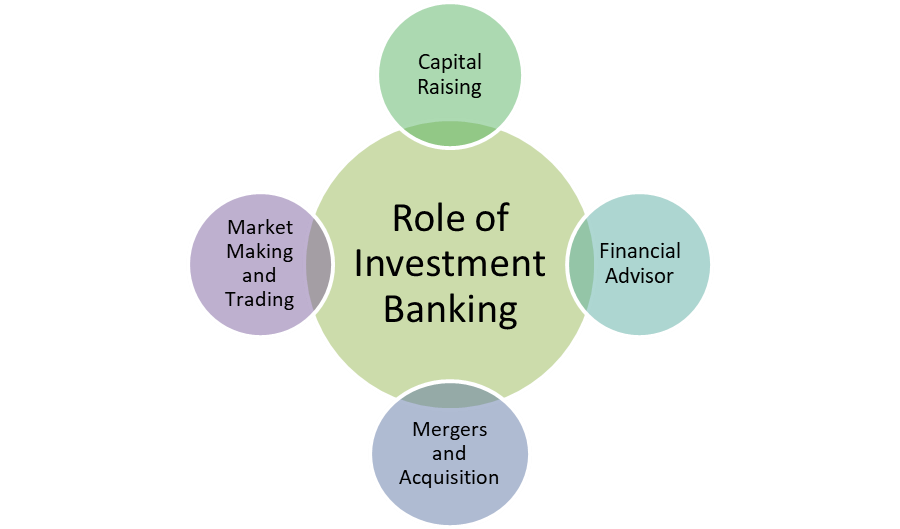

Role of Investment Banking

In the present century, investment banking has gained a lot of importance because of the role it plays. They act as a bridge between large enterprises and investors. Their primary role is to advise governments and businesses on how to face various financial challenges and to help them rise finance (capital). Given below are the major roles played by investment banking.

1. Capital Raising- Investment banks play a major role in facilitating the flow of capital in the financial system by helping companies, governments and other entities raise capital by the issue of share, bonds, debentures and other securities. This helps businesses to finance operations, invest in growth opportunities and undertake strategic initiatives.

2. Financial Advisor- Investment banks offers a wide range of financial advisory services to its companies and government clients including, risk management, financing strategies, capital structure optimization, etc. These advisory services help companies navigate through the complex financial challenges and make informed decisions to enhance their financial position.

3. Mergers and Acquisitions- Investment bankers play a major role in mergers and acquisitions of corporate companies from the beginning till the end. They advise companies on mergers, acquisitions and other corporate transactions. They help clients increase their shareholder value and achieve strategic objectives.

4. Market Making and Trading- Most major banks have trading departments that engage in trading activities across various asset classes. They act as market makers, providing liquidity to buyers and sellers in the financial market.

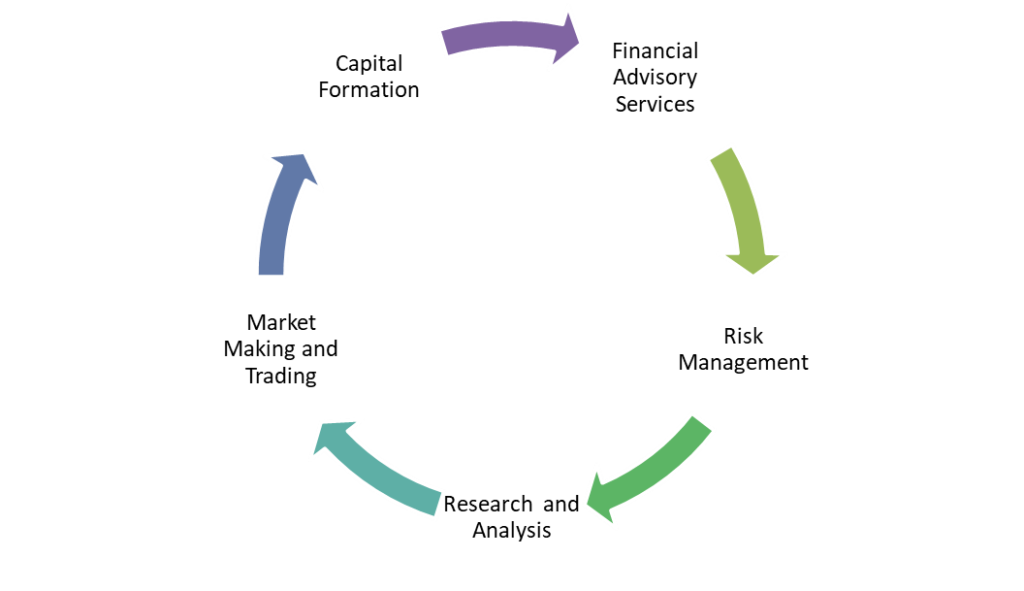

Importance Of Investment Banking

Investment banks hold significant importance in the global financial system. They serve as the backbone of the financial system, playing a vital intermediary between capital providers and capital seekers. Through their expertise in financial markets, risk management and regulatory compliance, investment banks help companies access the necessary funding to expand operations, pursue strategic initiatives and create value for shareholders. Additionally, their role in market making and trading enhances market liquidity and efficiency, contributing to the stability and integrity of the financial system.

What is Initial Public Offering (IPO) and What Is Investment Bankers Role In It?

Initial Public Offering or IPO is the process by which shares of a private company are made available to public for the first time and thereby becoming a publicly traded company. IPO allows a company to raise capital from the public.

During IPOs, investment bankers play a crucial role. They mainly play the role of middlemen between the investors and the issuer. They provide valuable advisory services and underwriting services for companies seeking to go public. Investment bankers help companies determine an appropriate price for an IPO. They act as underwriters for IPOs, helping companies raise capital by purchasing shares from the issuer and then selling them to the investors.

Given below are the ways investment bankers contribute to the IPO process.

- Advisory Services

- Underwriting

- Valuation

- Marketing and Distribution

- Stabilization

- Regulatory Compliance

Conclusion

In conclusion, investment banking plays a huge role in the global financial system. Their expertise, experience, and network of contacts are essential for navigating complex financial transactions and achieving successful outcomes for their clients. Overall, investment banking is an instrument in facilitating the efficient allocation of capital, promoting success and powering economic prosperity.