Welcome to our guide on saving. In this blog we will delve into what saving is and how saving is crucial for investing and a step-by-step guide to help you build a secure financial future. Let us dive in and discover the transformative power of savings!

Understanding Saving

Saving is the act of keeping aside a portion of income for a future use rather than on spending it all on expenditures immediately. It gives priority to long term goals over short term goals. It is not a one-time thing but rather a consistent and long term process.

Benefits of Saving

It is essential to save money in advance for your future as well as to deal with unforeseen events. The benefits or advantages of saving are as follows:

1. Financial Security: The habit of saving helps gain financial freedom and provides a sense of financial security and stability for your future. You can start saving by including a savings category to your budget and aim to save an amount that initially feels comfortable for you. Slowly increase you savings. Regardless of how much you are saving; it should provide enough stability to plan for your long term wealth building. Savings gives flexibility to make choices based on your values and priorities.

2. Emergency Fund: Consistent saving of money helps you meet any unforeseen expenses and other emergencies that may arise rather than borrowing money from others. Financial planners recommend that you should save at least 10% of your income towards an emergency savings fund. They suggest aiming to having enough savings to cover six months expenses in case you lose a job or face a financial emergency.

3. Goal Achievement: Saving helps you achieve your life goals in the long run. Whether it is to buy a house or to start a business saving enables you to work towards and achieve your financial goals.

4. Retirement Freedom: One of the greatest benefits of saving money is the advantage of time when building your retirement fund. Early and consistent saving of money helps to have a secure and stable life after retirement.

5. Investment: By putting your savings into a monthly SIP or Mutual Funds, etc. you can make your money grow by earning higher returns. By investing in various long term and short term plans you can beat the rising cost of inflation.

Step-By-Step Guide To Saving

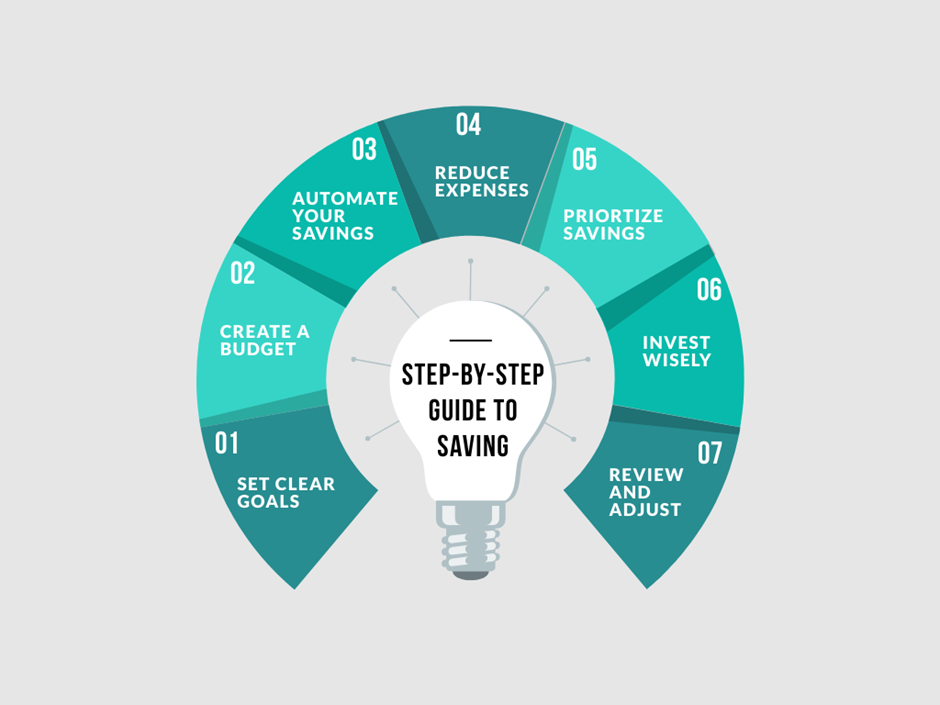

Sometimes the hardest thing about saving money is just getting started. Given below is a step-by step guide so that you can save for all your long and short term goals.

1. Set Clear Goals: One of the best ways to save money is to set goals. Identify your short term, medium term and long term financial goals like building an emergency fund, buying a house, retirement planning, etc.

2. Create a Budget: After setting your financial goals, prepare a budget. Track down all your incomes and expenses to know where your income is going and identify areas where you can cut back and save more.

3. Automate Your Savings: A simple way to save is to set up your bank account to cut a portion of your income and to transfer that amount to a savings account. This ensures consistency and discipline in your saving habits.

4. Reduce Expenses: Look for ways to reduce your spending. Identify your non-essential expenses and try to reduce spending money on them. Look for ways to save money on your monthly expenses.

5. Prioritize Savings: Treat saving as a non-negotiable expense and prioritize it in your budgeting. Include a savings category or item to your budget and aim to save an amount that initially feels comfortable for you. Slowly increase you savings by 10-20% of your income.

6. Invest Wisely: There are many savings and investment accounts suitable for long and short term goals. Consider investing your savings in a diversified portfolio of assets such as stock, bonds, or retirement account to generate wealth over long term. You may seek the help of financial advisor to make informed decisions that align with your financial goals.

7. Review And Adjust: Review your budget, financial goals, and investment portfolio to ensure that they align with your evolving financial situation.

Why Is Savings Crucial For Investing?

Saving and investment are two sides of the same coin, both having crucial role in building wealth. They are both important to consider in your future planning. Saving allows you to set aside money for future use whereas: investing is all about putting the saved funds to work in investment vehicles that have the potential to generate return over time.

Savings provides the initial capital for your investing. Explore and invest in those avenues that align with your financial goals, risk tolerance and time horizon. One of the fundamental principles of investment is diversification; spread your investment in across different asset classes and industries to reduce risk.

Finding the right balance between your saving and investment is the key to success. While saving provides security and stability, investing provides the potential for higher returns and accumulation of wealth. Start saving and investing today, and embark on a journey towards financial independence and prosperity.

Conclusion

Savings is not just about accumulating money; it is a strategic approach to managing your finances that can lead to greater financial stability, security and independence. By understanding the meaning, benefits, step by step guide and savings relation to investing you can take control of your financial future and achieve your financial goals with confidence.