Welcome to our guide on Budgeting! Whether you are striving to pay off your debt or simply aiming for better financial stability, the art of budgeting is your key to success. In this blog, we will help you understand the art of budgeting and the knowledge you need to create a budget that fits your lifestyle and goals.

What is Budgeting?

Budget is the process of creating and managing a plan for your finances. It involves setting up of financial goals, estimation of incomes, identification of expenses and allocation of funds to various categories based on your financial goals and priorities. It is an ongoing activity of tracking the spending, reviewing financial goals and making necessary adjustments when needed. Budgeting includes the preparation of the budget. So, what is a budget?

What is a Budget?

A budget is a comprehensive financial plan that outlines the anticipated incomes, expenses and the resources or funds required for a specific timeframe. It is a way to balance income and expenses for a specific period of time. In simple, a budget is a plan for the future based on one’s income and revenue.

What is the Importance of Budgeting?

A budget is a stepping stone to your financial goals. It assists you in achieving your financial goals. Given below are some of the reasons why budgeting is important.

1. Financial Awareness: Budgeting helps us to have a clear overview of our financial position. By tracking our incomes, expenses and spending habits, it helps us make informed decisions about our finances.

2. Goal Setting & Prioritization: Budgeting help set financial goals and allocate resources for it. It helps you prioritize your financial goals and help achieve them.

3. Debt Management: Budgeting is a great tool for managing debt. It helps allocate fund towards debt payment, prioritize high interest rates and track you progress towards becoming debt free.

4. Long-term Financial Goals: Consistent budgeting is good for long term success. It helps develop good money management habits, build wealth overtime and achieve financial stability.

5. Savings & Emergency Funds: Budgeting helps in establishing a savings habit and by doing so can use this fund in case of any emergencies.

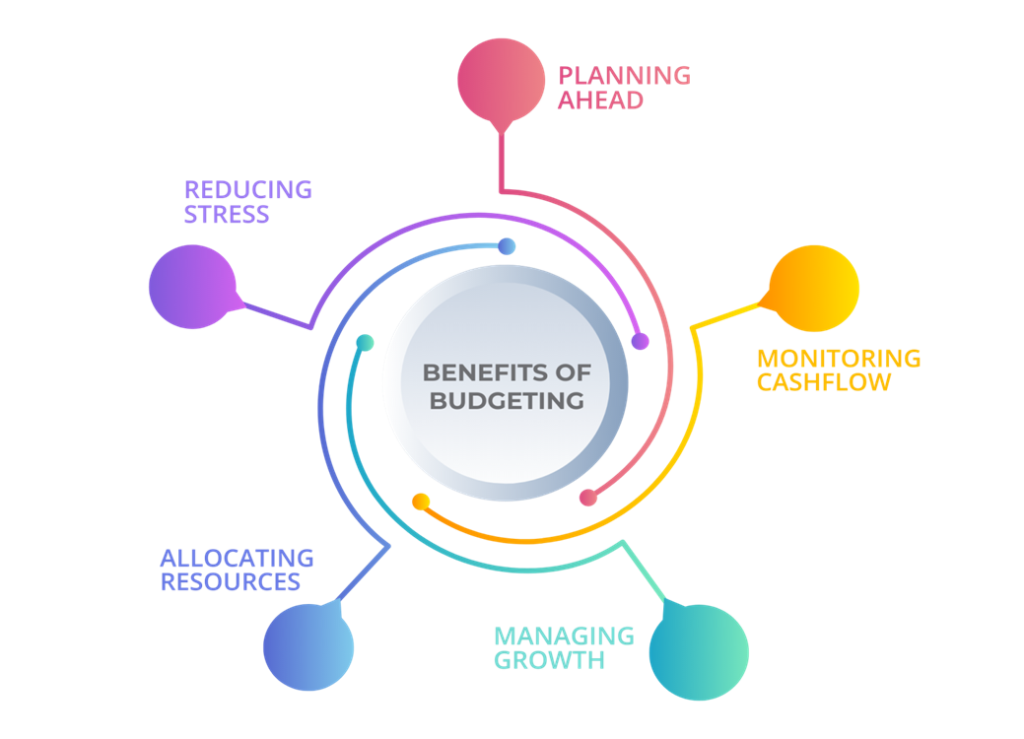

What are the Benefits of Budgeting?

How to Make a Budget in 5 Easy Steps?

A budget is a financial tool that helps you control your expenses and save for the future. So how can you make a budget for yourself?

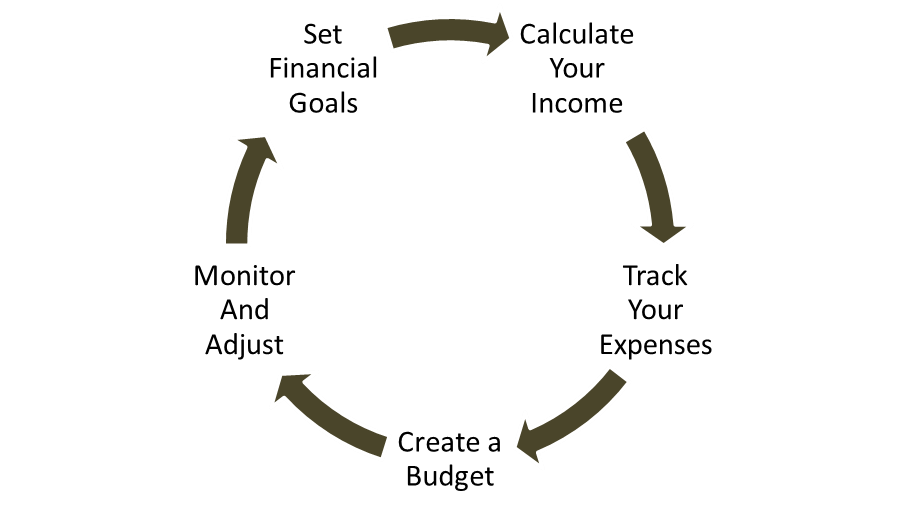

The following are the 5 fundamental steps to create an effective budget.

1. Set Financial Goals: Determine your financial goals and prioritize them. Establishing your goals can guide you in your budgeting process. These financial goals can be long term and short term like pay off debts, vacations, retirement funds, house or car purchase, etc.

2. Calculate Your Income: The next step is to estimate the income you are supposed to get from all sources. This may include salary income, investment income, government allowances, etc.

3. Track Your Expenses: Determine the expenses you may incur during the particular time period. The expenses may be fixed expenses (rent, interest, etc.) and variable expense (entertainment, transportation, groceries, etc.). Tracking your expenses can help you in knowing where all money is going and thereby reduce cost wherever possible.

4. Create a Budget: After knowing your all your expenses and income, you can prepare a plan to allocate your income among various categories like housing, utilities, retirement funds, other savings goals( mutual funds, investment), etc..

5. Monitor and Adjust: Regularly monitor your actual spending with your budget. Compare them and make necessary adjustments wherever required.

Conclusion

In simple, budgeting is a powerful tool that empowers individuals to control their finances, achieve their goals and build a secure future. In this blog, we have come across the fundamentals of budgeting, their importance and steps. Remember your journey to financial freedom starts today. Start budgeting today, and take control of your financial future.