Which one should I invest in, Mutual Funds or Real Estate? This is one of the most common questions that come in the minds of investors at the beginning of one’s investment journey. In this article we discuss about both types of investments based on their financial objectives, risks, etc.

What is Real Estate Investment?

Real estate investment is the practice of purchasing, owning, managing, renting or selling of real estate properties with primary objective of generating income, capital appreciation or both. In simple it is any piece of land, building or any other tangible asset that can be transferred to earn income or profit. Real estate is a significant and diverse sector that plays a crucial role in the development of the economy of a nation.

What is Mutual Funds Investment?

Mutual Funds is an investment option that pools money from a number of investors who share a common investment objective and invests this money in stocks, bonds and other such securities. The pool of money is managed by a professional fund manager or a team of managers. These managers make investment decisions on behalf of the investors. The combined holdings, that is, the collection of securities, in the mutual funds is known as portfolio.

What are the pros and cons in Mutual Fund Investment?

The advantages or pros of investing in mutual funds are as follows:

- Simple to Invest

- Professionally Managed

- Offers Diversification

- Poential for Higher Returns

- Highly Regulated

- Convenience to Unit Holders

- Risk Management

The following are the disadvantages of investing in mutual funds:

- Mutual Funds are subject to market risk

- No control over cost

- Higher Risk

- Potential for market volatility

- No Guarantee on Return

- Not for Short-term

What are the pros and cons in Real Estate Investment?

The advantages of investing in real estate are the following:

- Increase in Value Over Time

- Ability to Leverage and Secure Loan

- Hedge Against Inflation

- Potential to Generate Income

- Ability to Control the Asset

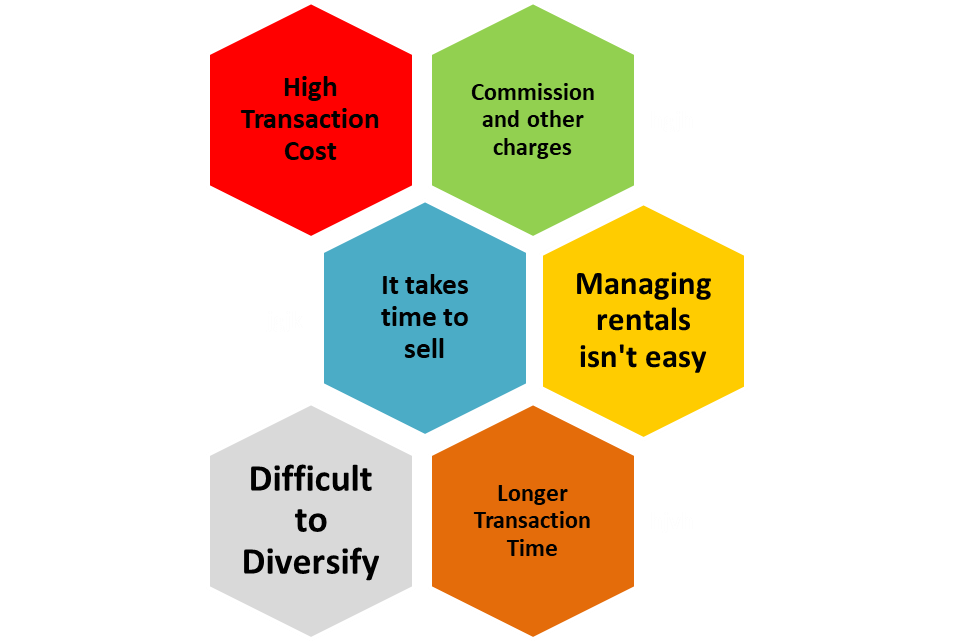

The disadvantages of investing in real estate are as follows:

- High Transaction Cost

- Commission and other charges

- It takes time to sell the property

- Managing Rentals is not Easy

- Difficult to Diversify

- Longer Transaction Time

Which one is ‘better’?

Ultimately, the better investment option depends on one’s individual circumstances, financial goals, long term or short term objectives, risk tolerance and other personal preferences.

Some investors may prefer the tangible nature of real estate and the potential for appreciation of value and control offered by the real estate properties, while some others prefer the liquidity and diversification offered by mutual funds.

There are some investors who choose a diversified portfolio by investing in both real estate and mutual funds to spread risk and gain profit from different investment opportunities. It is preferred to consult a financial advisor to assess your goals and risk tolerance to make informed decisions that aligns with your investment objectives.